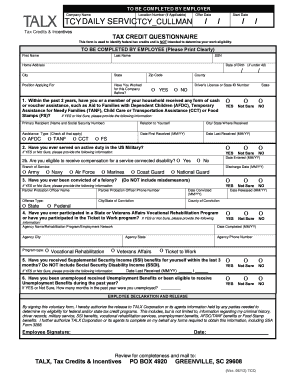

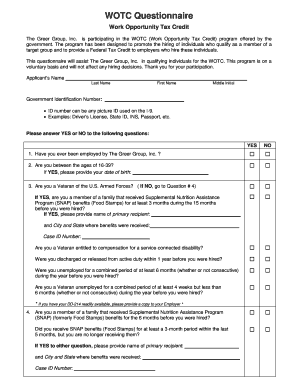

work opportunity tax credit questionnaire form

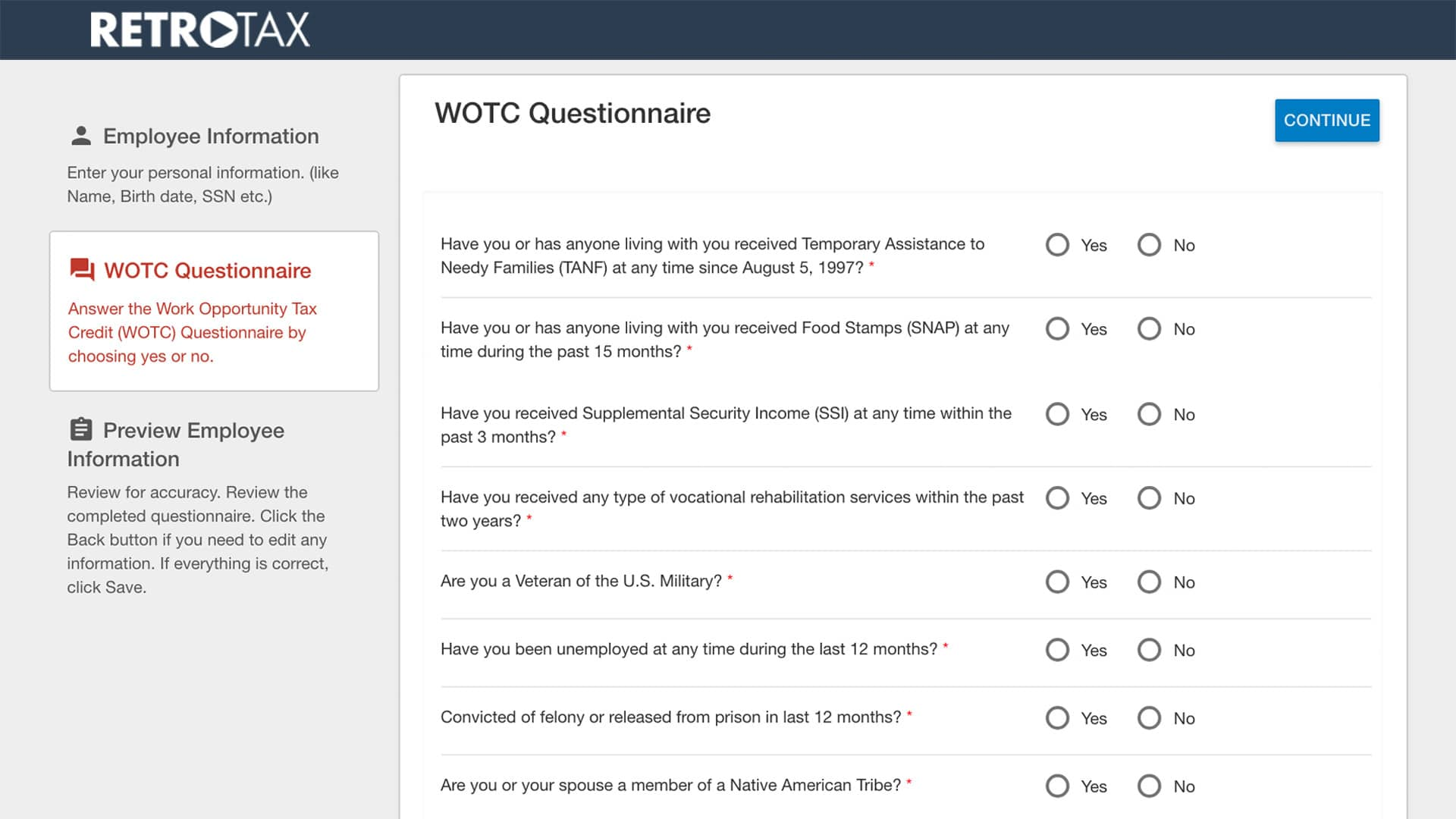

Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. WOTC Improve Your Chances of Being Hired.

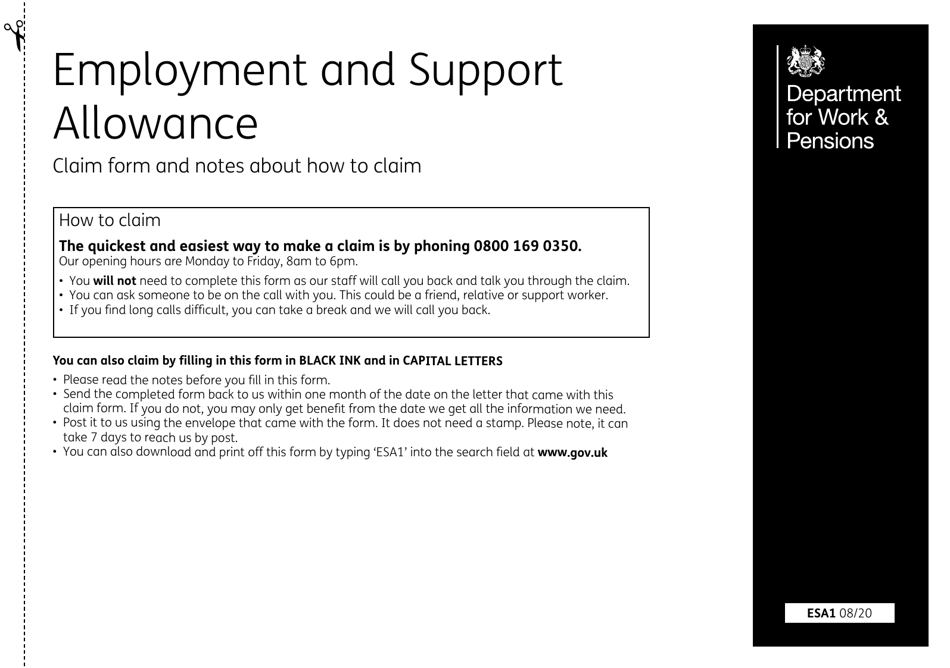

Form Esa50 Download Printable Pdf Or Fill Online Capability For Work Questionnaire United Kingdom Templateroller

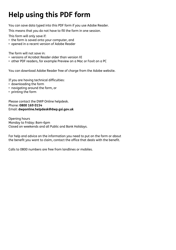

Simple fast and secure technology that optimizes Form 8850 completion and program results.

. Employbridge Work Opportunity Tax Credit Questionnaire. Discover why were a leading questionnaire platform around the globe. Governments often enact tax incentives for businesses to hire workers.

Employers may meet their business needs and claim a tax credit if they. Complete only this side. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them.

This government program offers participating companies between 2400 9600 per new qualifying hire. WOTC Eligibility Questionnaire The Work Opportunity Tax Credit. WOTC Target Groups include.

Ad Create a questionnaire online for free. Completion of this form is voluntary and may assist members of targeted. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that includes Veterans people who have been on food stamps ex. Famed English actor Jeremy Irons said The secret to life is timing.

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Examples include the federal Hiring Incentive to Restore Employment Act and the Work Opportunity Tax Credit. This tax credit may give the employer the incentive to hire you for the job.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

Work Opportunity Tax Credit Management. January 2012 Department of the Treasury Internal Revenue Service Pre-Screening Notice and Certification Request for the Work Opportunity Credit a See separate instructions. Completing Your WOTC Questionnaire.

Ad Create a questionnaire online for free. Get the most out of the Work Opportunity Tax Credit WOTC. 1 the employer or employer representative the SWA a participating agency or 2 the applicant directly if a minor the parent or guardian must signtheform andsignedBox.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Your name Social security number a. The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals.

ETA Form 9061 Individual Characteristics Form. So too is success with the Work Opportunity Tax Credit. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website.

Settembre 24 2020 Nessun commento su Employbridge Work Opportunity Tax Credit Questionnaire. ETA Form 9062 Conditional Certification. Help state workforce agencies SWAs determine eligibility for the Work Opportunity Tax Credit WOTC Program.

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. And administered by the Internal Revenue Service. Your new employer participates in a federal work initiative called the Work Opportunity Tax Credit.

With WOTC Timing is Everything. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. Get answers actionable insights.

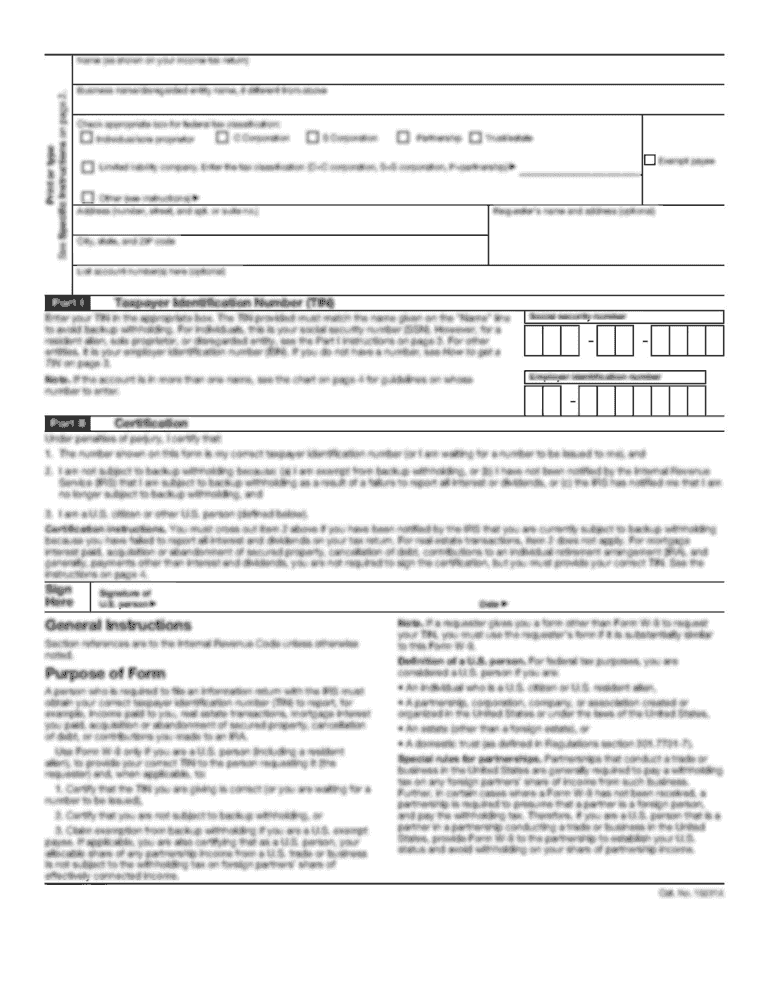

The information will be used by the employer to complete the employers federal tax return. Get answers actionable insights. IRS Form 8850 PreScreening Notice and Certification Request for the Work Opportunity Tax Credit.

Also known as WOTC pronounced Watt See the Work Opportunity Tax Credit rewards businesses with 2400 to 9600 in federal income tax credit when they hire members of a. The Work Opportunity Tax Credit WOTC can help you get a job. Employers need a way to screen these job applicants and thats where a tax.

Settembre 24 2020 Nessun commento su Employbridge Work Opportunity Tax Credit Questionnaire. Eliminate cumbersome tax form distribution processes. Discover why were a leading questionnaire platform around the globe.

Fill in the lines below and check any boxes that apply. The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. Information about Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit including recent updates related forms and instructions on how to file.

Tax incentives make it easier for businesses to increase hiring and help reduce unemployment. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment. Are employees required to fill out WOTC form.

The form may be completed on behalf of the applicant by. Employbridge Work Opportunity Tax Credit Questionnaire. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form.

Tap our proprietary technology to help simplify the process identify more WOTC eligible employees and capture more tax credits for your company. Employers use Form 8850 to make a written request to their SWA to certify someone for the work opportunity credit. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person.

Our Work Opportunity Tax Credit Screening Services deliver bottom line savings to businesses by screening new hires for WOTC and other tax credit eligibility. Federal Forms and Information. Is participating in the WOTC program offered by the government.

Work Opportunity Tax Credit First Advantage

Completing Your Wotc Questionnaire

Work Opportunity Tax Credits Wotc Walton

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Wotc Form Fill Out And Sign Printable Pdf Template Signnow

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

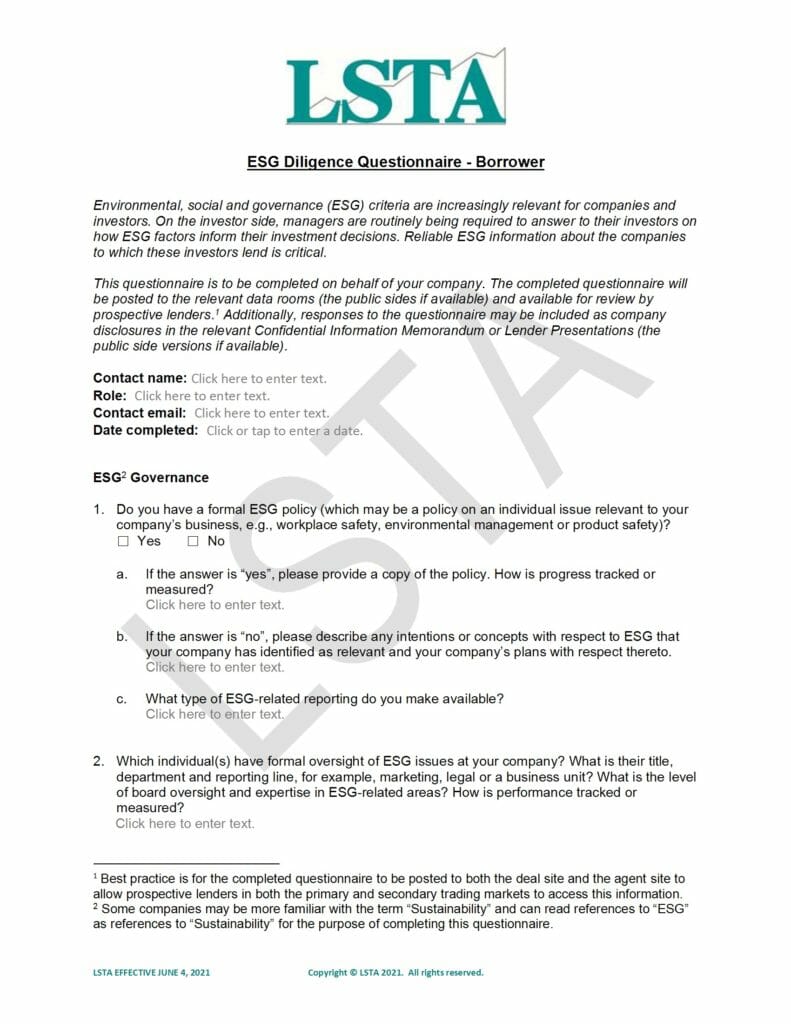

Esg Diligence Questionnaire Borrower Lsta

Form Esa1 Download Fillable Pdf Or Fill Online Employment And Support Allowance United Kingdom Templateroller

Work Opportunity Tax Credit What Is Wotc Adp

Tops 8 1 2 X 11 Inch Employee Application 50 Sheet Pads 2 Pack 32851 Amazon Co Uk Stationery Office Supplies

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit What Is Wotc Adp

Form Esa50 Download Printable Pdf Or Fill Online Capability For Work Questionnaire United Kingdom Templateroller

Work Opportunity Tax Credit What Is Wotc Adp